(Image: Tim Mossholder/Unsplash)

Starting a business is rarely easy for anyone, but research shows entrepreneurs of color face even more of an uphill climb. In the U.S., entrepreneurs of color are significantly less likely to end their business profitably and many end up losing money, according to a 2023 report from the economic equity nonprofit Prosperity Now.

This is not only devastating for business owners, but it also contributes to a persistent racial wealth gap in which the typical white household has about six times as much wealth as the typical Black household and five times as much as the typical Hispanic household, based on the latest Federal Reserve Survey on Consumer Finance.

“Small businesses owned by people of color can help build intergenerational wealth, but it's only if these businesses are sustainable and profitable,” Doug Ryan, vice president of policy and applied research at Prosperity Now, told TriplePundit. “If they're losing money or they go bankrupt or they fail or they're not able to expand in a meaningful way or be acquired, it's not a sustainable wealth-building strategy for the individual, for the business owner, for the community, or for the country at large.”

In an effort to understand why former entrepreneurs of color walk away from their businesses and to begin to identify potential solutions, Prosperity Now explored a less charted area of entrepreneurship research: the experiences of former business owners.

The data in its Former Entrepreneurs of Color report shines a spotlight on these individuals, revealing unique challenges and systemic barriers they faced. Key findings indicate stark disparities in profit and loss outcomes between white and minority former business owners.

For example, about half of white former entrepreneurs reported a profitable final year of business, and a quarter said they managed to break even. But only around a quarter of Black former entrepreneurs reported profits in their last business year, and another quarter broke even. Among Hispanic former business owners, 38 percent garnered profits in their last business year, while around a quarter reached a break-even point. Additionally, more of the former white business owners sold their enterprise at a profit, whereas more Black and Hispanic entrepreneurs sold their businesses at a loss.

The barriers for entrepreneurs of color

While some of the well-known challenges of being an entrepreneur were evident across all racial and ethnic groups — feeling burnt out and undergoing a significant life event cited as the top reason for closing or ending a business by all former entrepreneurs — the study revealed pronounced disparities by race and ethnicity.

Hispanic former entrepreneurs more frequently attributed business closure to financial challenges, while Black former entrepreneurs more frequently cited operations challenges as a reason for closure.

In addition, Hispanic former entrepreneurs more frequently cited financial challenges as reasons for business closure. Some 95 percent of Hispanic entrepreneurs identified making rent or mortgage payments for their business as a main challenge leading to closure.

Personal finances were the primary financial reason for closing a business across all groups. “How do you address that? I'm not really sure. But what it suggests is that it's really expensive to run a business, and people only have so much appetite for losing money,” Ryan said.

While some of the challenges of owning a business show similarities, no single solution can address them all, Ryan said. “Business owners of color raised some big issues that will not be readily addressed by one type of intervention or another because they are systemic in some ways.”

At a high level, improvements across three structural areas — access to capital, technical assistance and public support — could begin to dismantle some of these barriers, he said.

Expanding access to capital through community development financial institutions

Access to capital to support business operations was a significant barrier for almost all of the Hispanic former entrepreneurs surveyed, as well as 69 percent of Black and 62 percent of white former entrepreneurs.

A potential solution that is currently underleveraged are nonprofit community development financial institutions (CDFIs). These are lenders with a mission to provide fair, responsible financing to rural, urban, Native, and other communities that mainstream finance doesn’t traditionally reach. They serve as critical resources for small businesses in Black and Latinx communities, creating a secondary market for innovative small business lending, Ryan said.

“We have a 25-year-plus history with CDFIs, and building out their capacity to meet the needs of entrepreneurs of color is really important,” he told us. “Because they're nonprofits and they're also community-based, they are positioned differently than other lenders or other financial institutions to provide technical assistance and be the connective tissue with other resources in the community.”

The more than 1,300 certified CDFIs nationwide manage more than $222 billion, much of which they invest locally to create jobs, affordable housing, financial health, and opportunity for their communities — which can be transformational for investing in communities of color, as TriplePundit has reported.

In April 2023, the U.S. Treasury Department awarded $1.73 billion to hundreds of CDFIs to strengthen their ability to help low- and moderate-income communities recover from the COVID-19 pandemic and invest in long-term prosperity. This infusion of funding can help CDFIs scale further “so they can help small business owners, particularly Black and Latino business owners, sustain themselves, become profitable and begin to create intergenerational wealth,” Ryan said.

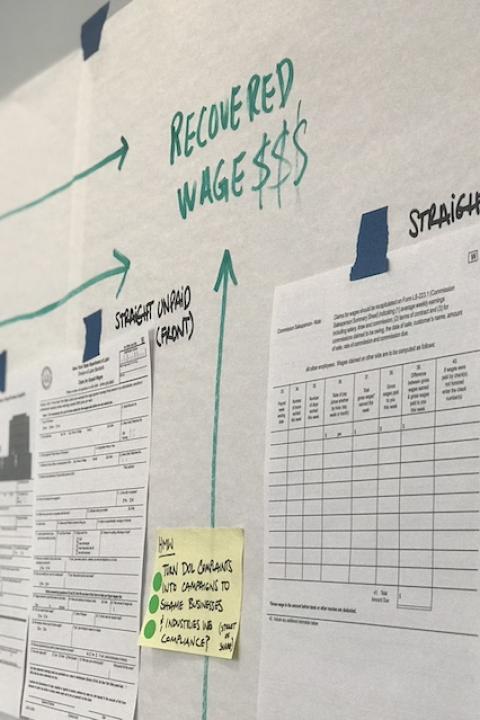

Tapping into government resources for technical assistance

Black former entrepreneurs more frequently cited business operations challenges, such as navigating government regulations and maintaining business licenses, as a reason for business closure, according to Prosperity Now’s survey. This finding underscores how crucial it is for entrepreneurs of color to get the technical assistance they need.

“From the big-picture perspective, technical assistance and access to capital are absolutely necessary for a small business to succeed. But what are the hurdles to addressing that?” Ryan said.

One welcome development is the decision in 2021 by Congress to codify the Minority Business Development Administration (MBDA) within the Department of Commerce to make it permanent, he said. The MBDA is the only federal agency solely dedicated to the growth and global competitiveness of minority business enterprises. It invests in a national network of MBDA business centers, specialty centers, and grantees, offering customized business development and industry-focused services to provide greater access to capital, contracts and markets.

The Congressional vote to codify this Nixon-era agency matters because “it gives it more heft and, frankly, more of the certainty that businesses and other investors would rely on,” Ryan said. "For example, if you're getting assistance from the MBDA and you are looking for outside investors, it gives investors the confidence that you're going to have the support in the long run because this is now a statutory organization.”

In August, the MBDA announced the Capital Readiness Program, a $125 million technical assistance program to help minority and other underserved entrepreneurs grow and scale their businesses.

“That’s not a lot of money in a $25 trillion economy but it is a lot of money if it is targeted the right way,” Ryan said. “If you couple that with what the MBDA is doing with the business centers, which are effectively incubators, we could really make some progress.”

Strengthening networks can fill critical gap in support

Another key finding was a critical gap in community and professional support that led to business closures among former minority entrepreneurs. Community support deficits led to business closure for 97 percent of Hispanic and 73 percent of Black former business owners, compared to 67 percent of white former entrepreneurs. This illuminates the third structural area to address: strengthening professional networks and other forms of support.

Black and Hispanic entrepreneurs more frequently reported a lack of family support and a lack of access to professional guidance and role models as a reason they had to close their business.

For Ryan, the other two structural gaps — access to capital and technical assistance from either the government or other entities — are tied to this lack of community support.

“If you have a local network within your field or industry, you're more likely to be able to navigate not just the access to capital, but also the technical assistance offered through more formal networks such as local business incubators that could help reduce costs for office or other real estate space, for example,” Ryan said. “Our report shows that when you don't have those resources or those networks to fall back on, it does make those businesses less likely to succeed.”

This support — while undeniably helpful if it comes from professional networks, family or community support — must ultimately come from the government to have an impact at scale, Ryan said.

“Government at all levels has to do a better job in reaching out to underserved communities with the resources they have available — from small business lending, to technical assistance, to incubators, to tax credits, to tax filing assistance, to licensure and much more,” he explained. “We need to take away some of the roadblocks to build out people’s ability to succeed.”

Indeed, when businesses owned by Black and Hispanic entrepreneurs fail, can’t get off the ground, or underperform, it doesn’t just exacerbate the racial wealth gap, but it also has an outsized impact on the U.S. economy. If privately-held, Black-owned businesses had the same revenue averages as white-owned firms, it would pump another $200 billion into the economy, according to a 2020 study by the global management consulting firm McKinsey & Co.

Based in Florida, Amy has covered sustainability for over 25 years, including for TriplePundit, Reuters Sustainable Business and Ethical Corporation Magazine. She also writes sustainability reports and thought leadership for companies. She is the ghostwriter for Sustainability Leadership: A Swedish Approach to Transforming Your Company, Industry and the World. Connect with Amy on LinkedIn and her Substack newsletter focused on gray divorce, caregiving and other cultural topics.